Fotolia

Top drivers of digital transformation projects have inward focus

Our IT Priorities Survey shows that close to 70% of companies are pursuing digital transformation. Learn what metrics they're targeting and how they're spending 2019 IT budgets.

"Digital transformation" has become the buzzword du jour for product and services vendors, and industry analysts. But putting the hype aside, digital transformation is a very real and often formidable undertaking for the many companies looking to modernize their IT operations. Still, there is no single definition of what digital transformation entails. What might be a critical part of the process of bringing systems into the 21st century for one company may not even register on another company's transformation Richter scale.

The breadth of transformation efforts is borne out by the results of the most recent edition of TechTarget's exclusive IT Priorities Survey, which focuses on the key initiatives for enterprise and SME IT shops for the coming year. Now in its 11th year, the survey queried 624 IT professionals from a wide range of industries based in North America.

Drivers of digital transformation vary

Digital transformation -- however it's defined -- figured prominently in the survey responses. More than two-thirds of respondents in our IT Priorities Survey indicated that their companies were active in some phase of transformation. Nearly half -- 46% -- have formal projects underway.

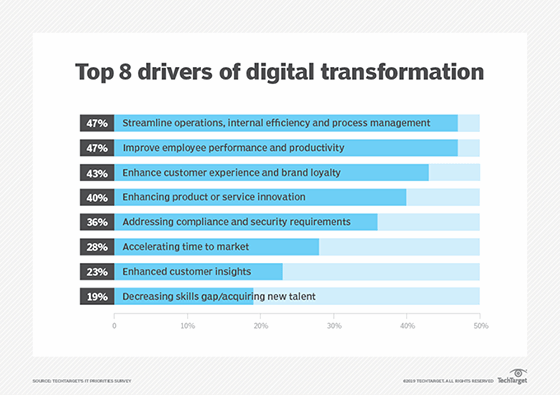

Just as the specific technological targets may vary, companies' motivations for embarking on a digital transformation journey address an equally wide variety of goals. Although digital transformation efforts are often touted as the key to effective customer relations, the two most often cited drivers of digital transformation are more inwardly focused: Forty-seven percent indicated that streamlining operations and improving internal efficiency were the key drivers of digital transformation, and a similar number cited improving employee performance and productivity.

The more frequently touted customer-facing criteria were also well represented, with 43% ranking enhancements to their customers' experience as a priority and 40% seeking to enhance their product innovation.

In last year's survey, enhancing customers' experiences was most frequently associated with digital transformation (48%) with improving worker productivity following at 43%. The shift in digital transformation drivers might be attributable to the realization that to serve customers better, internal processes need to be tightened up first.

As varied as their goals, what companies are doing to achieve them crisscrosses technologies both old and new. Again focusing inwardly, our survey respondents picked increasing their investment in techs that improve employee experience and productivity (39%) as the leading transformation activity. Stepping up their use of cloud services was the No. 2 activity (38%). Just a couple of points back at 36% were two environmental upgrades: modernizing legacy applications and refreshing or upgrading on-premises IT infrastructure. Clearly for many companies, transformation starts with propping up aging IT foundations.

Read our in-depth guide for details of how the role of the CIO has evolved along with the consumerization of IT and learn what is required of chief information officers today.

Budgets upped to foot transformation bills

Brushing the dust off an aging data center to do a systems remodel can be an expensive proposition. For most of the companies that participated in our survey, some additional budget bucks will help facilitate the process.

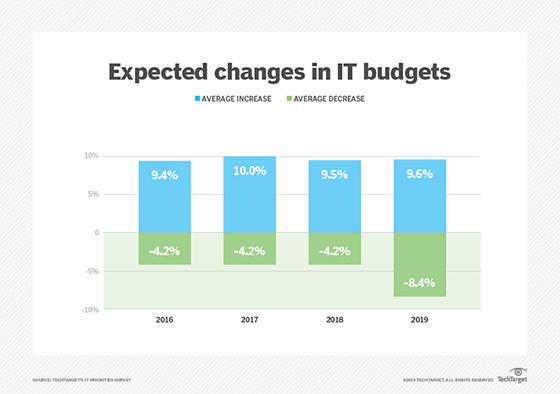

Fifty-five percent of respondents told us that they expected their IT budgets to rise over last year's level, while only 6% expected some cuts. (About 20% anticipated no change.) Those numbers indicate a slight uptick from last year's reporting, when 50% anticipated increased budgets and 8% were bracing for a decline.

For 2019, the average budget increase will be about 9.6%, while budgets that are dropping will decline by an average of 8.4%. The increase is consistent with what we've seen over the past few years, but the decrease is higher than in past years.

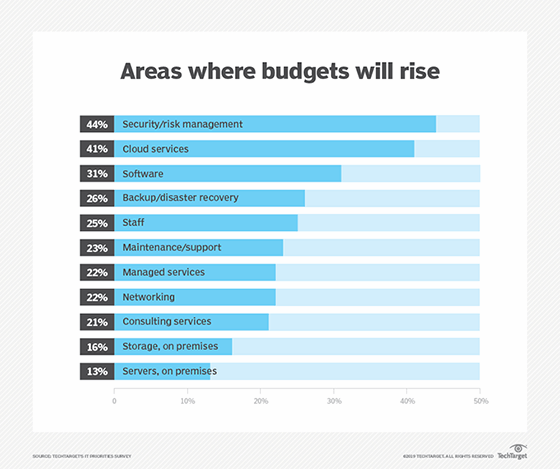

For all respondents -- both budget gainers and losers -- the stop for IT shopping will be in the security department. With ransomware and other attacks becoming more sophisticated, 44% of respondents will try to batten down the IT hatches by increasing their spending for security and risk management. Nearly as many companies (41%) will increase their budgets to expand their use of cloud services -- a key step in most digital transformation methodologies and one that can be taken with greater confidence as tools to manage multi-cloud environments are readily available today.

On the flip side, the areas where IT pros are looking to cut back expenditures are two traditional data center bugaboos: Consulting services were cited by 48% as an area likely to see cutbacks and, with the shift to more cloud services, 38% expect to reduce maintenance and support charges. And as a result of an increased cloud presence, 29% expect to cut their budgets for on-premises servers.

Clearer outlook for cloud

Regardless of how far along companies are in their transformation journeys or how varied their key drivers of digital transformation may be, it's a reasonably safe bet that cloud services will play a prominent role in achieving their goals, with apps that traditionally resided in-house shifting into the ether.

Survey respondents are considering moving to cloud-based services for virtually all types of applications. The list of apps is top heavy with those applications that use large amounts of data -- BI/analytics (27%), CRM and sales management (23%), big data/data warehouse/data lake (21%) and traditional database apps (20%). Clearly, parking tons of data in a cloud is becoming the preferred alternative over building massive in-house infrastructure.

As companies begin to dabble in newer technologies, the cloud is often the preferred platform. For example, 19% of our respondents said they would pursue machine learning projects in the cloud rather than using on-premises gear.

Perhaps the most telling result that indicates the cloud era is indeed finally here is the number of respondents who said they had no plans to deploy applications in the cloud in 2019 -- just 10%.

Demise of the data center not imminent

Cloud is definitely on the rise, but any notion that data centers are on the brink of extinction would be premature at best. Just as companies seek to use multiple cloud services to balance their risks, many companies also seek a comfortable balance between cloud and in-house operations. Managing and securing corporate data is job No. 1 in most companies: Security and risk management was cited most often (39%) in our IT Priorities Survey as a key data center project for 2019 -- not a surprising preference considering the huge growth in data, compliance issues such as the GDPR and the unrelenting onslaught of hacker attacks.

Second on the list of data center to-dos for 2019 is Windows Server 2016 migration (26%), closely followed by general server refreshes (24%). So, even as digital transformation tightens its grip on data centers, there are still a lot of traditional tasks that require attention.

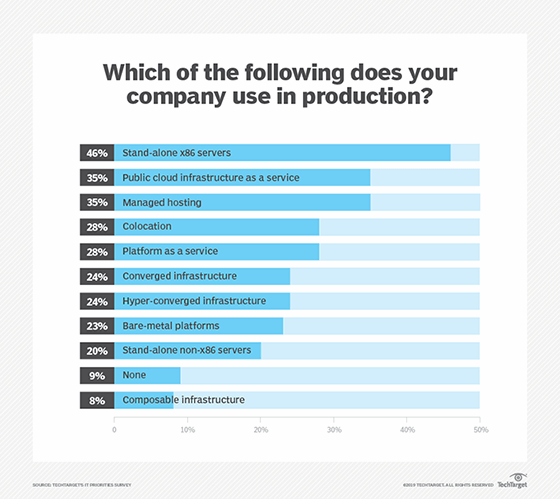

Enterprises will have to tinker with their installed environment, as well as their use of managed and cloud services as new technologies and techniques put pressure on established and often reliable legacy infrastructure.

How do you expect your total compute capacity to change for the following over the next 12 months?

| Increase |

Stay the same |

Decrease |

|

| Platform as a service (PaaS) |

86% |

12% |

2% |

| Public cloud IaaS |

80% |

18% |

2% |

| Hyper-converged infrastructure |

68% |

22% |

10% |

| Managed hosting |

61% |

33% |

6% |

| Converged infrastructure |

47% |

39% |

14% |

| Composable infrastructure |

45% |

40% |

15% |

| Colocation |

43% |

43% |

14% |

| Bare-metal platforms |

27% |

28% |

45% |

| Stand-alone x86 servers |

21% |

40% |

39% |

| Stand-alone non-x86 servers |

19% |

44% |

37% |

IT is a big ship that changes direction slowly

Our survey bears out the fact that even the most revolutionary new technologies rarely have an immediate impact in our data centers. The transformation -- whether it's digital or more anchored in legacy operations -- typically happens at a more evolutionary pace.

The companies represented in our survey results have their hands full -- 23% of respondents indicate that they're stewards of more than a petabyte of data stored in on-premises devices, and 13% are managing an equal amount of data in the cloud. That's a lot to consider for any type of transformation.