cloud application

What is a cloud application?

A cloud application, or cloud app, is a software program where cloud-based and local components work together. This model relies on remote servers for processing logic that is accessed through a web browser with a continual internet connection.

Cloud application servers are typically located in a remote data center operated by a third-party cloud services infrastructure provider. Cloud-based application tasks might encompass email, file storage and sharing, order entry, inventory management, word processing, customer relationship management (CRM), data collection, or financial accounting features.

How cloud apps work

Cloud applications use a client-server architecture. Users interact with the program via a client interface, such as a web browser or mobile device app, but the application's compute cycles and data is stored in a remote data center typically operated by a third-party company. A back end ensures uptime, security and integration and supports multiple access methods.

Cloud applications are fast and responsive and don't get to permanently reside on the local device. They can function offline but can be updated online.

While under constant control, cloud applications don't always consume storage space on a computer or communications device. Assuming a reasonably fast internet connection, a well-written cloud application offers all the interactivity of a desktop application, along with the portability of a web application.

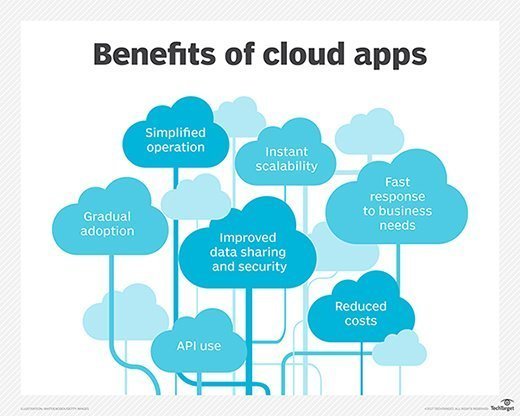

Benefits of cloud apps

Cloud computing offers several advantages for businesses. Common benefits of cloud apps include the following:

- Fast response to business needs. Cloud applications can be updated, tested and deployed quickly and on-demand, providing enterprises with fast time to market and agility. This speed can lead to culture shifts in business operations.

- Simplified operation. Infrastructure management systems can be outsourced to third-party cloud providers.

- Instant scalability. As demand rises or falls, available capacity can be adjusted.

- Application programming interface (API) use. Third-party data sources and data storage services can be accessed with an API. Cloud applications can be kept smaller by using APIs to hand data to applications or API-based back-end services for processing or analytics computations, with the results handed back to the cloud application. Vetted APIs impose passive consistency that can speed development and yield predictable results.

- Gradual adoption. Refactoring legacy, on-premises applications to a cloud architecture in steps enables components to be set up on a gradual basis.

- Reduced costs. The size and scale of data centers run by major cloud infrastructure and service providers, along with competition among providers, have led to lower prices. Cloud-based applications can be less expensive to operate and maintain than equivalent on-premises installations.

- Improved data sharing and security. Data stored on cloud services is instantly available to authorized users. Due to their massive scale, cloud providers can hire world-class security experts and configure infrastructure security measures that typically only large enterprises can obtain. Centralized data managed by IT operations personnel is more easily backed up on a regular schedule and restored should disaster recovery become necessary.

- Enhanced collaboration. Collaboration features are commonly integrated into cloud applications, enabling multiple users to collaborate on a shared document or project concurrently. This promotes increased productivity and facilitates seamless teamwork, as users can effortlessly share and edit files in real time.

- Automatic updates and maintenance. The service provider automates the updates for cloud apps, saving users from having to manually update them and giving them access to the newest features and security patches. This lessens the chance of utilizing out-of-date software and saves IT staff a lot of time and work.

Cloud app designs

Cloud applications are categorized into three primary designs, each built to fulfill specific requirements and functions. The three cloud infrastructures include the following:

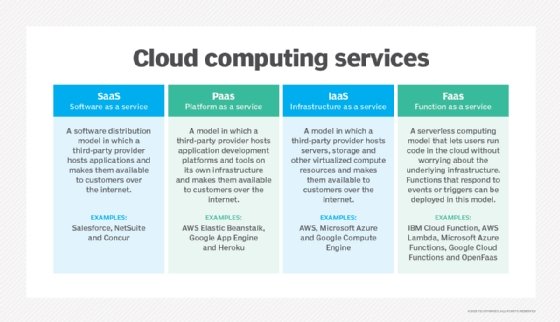

Software as a service (SaaS)

This is the most common type of cloud app. SaaS applications run remotely with software housed on third-party hardware and users can use a specialized client or a web browser to access these programs.

SaaS can be a great option for companies or individuals who prefer software subscription models, require minimal customization, or do not want to be responsible for managing cloud platforms, software, or infrastructure.

Because SaaS eliminates the need to invest in a strong on-premises IT infrastructure or make permanent software purchases, it lowers users' upfront expenditures. Examples of SaaS applications include Dropbox, Evernote, Salesforce, WIX, Google Docs and Google Drive.

Platform as a service (PaaS)

With PaaS, developers can create, launch and maintain apps on a platform without worrying about the underlying infrastructure. It provides a comprehensive environment for development and deployment, replete with frameworks, libraries and tools, making it an ideal option for developers and programmers.

Examples of PaaS vendors include Google App Engine, Microsoft Azure App Service and Heroku.

Infrastructure as a service (IaaS)

In IaaS cloud computing services, the infrastructure -- including physical servers, networks, virtualization and storage -- is managed by a provider on behalf of the user via a public cloud or a private cloud. While the provider handles outages, maintenance and hardware issues, the user can control things such as OS, apps and middleware by gaining access to the infrastructure through an API or dashboard.

Amazon Web Services (AWS), Microsoft Azure and Google Compute Engine are a few examples of IaaS providers.

Cloud apps vs. web apps

With the advancement of remote computing technology, the lines between cloud and web applications have become blurred. The term cloud application has gained great cachet, sometimes leading application vendors with any online aspect to brand them as cloud applications.

Cloud and web applications access data residing on distant storage. Both use server processing power that may be located on-premises or in a distant data center.

A key difference between cloud and web applications is architecture. A web application or web-based application must have a continuous internet connection to function. Conversely, a cloud application or cloud-based application performs processing tasks on a local computer or workstation. An internet connection is required primarily for downloading or uploading data.

A web application is unusable if the remote server is unavailable. If the remote server becomes unavailable in a cloud application, the software installed on the local user device can still operate, although it cannot upload and download data until the service at the remote server is restored.

Examples and use cases of both cloud and web applications include the following:

- Email. Gmail is an example of a web application that requires only a browser and internet connection. Through the browser, it's possible to open, write and organize messages using search and sort capabilities. All processing logic occurs on the servers of the service provider (Google, in this example) via either the internet's HTTP or HTTPS protocols.

- CRM. A CRM application such as Salesforce that is accessed through a browser under a fee-based SaaS arrangement is a web application. Online banking and daily crossword puzzles are also considered web applications that don't install software applications locally.

- Social media. Social media platforms such as Meta and Instagram operate on a web-based application. These platforms enable users to connect with friends, share profiles, updates, photos and videos and interact with other features and functionalities.

- Word processing. An example of a word-processing cloud application that is installed on a workstation is Microsoft Office 365 Word. The application performs tasks locally on a machine without an internet connection. The cloud aspect comes into play when users save work to an Office 365 cloud server.

- Virtual meetings. Zoom, which is a video conferencing and collaboration app, is an example of a cloud application. It's hosted on the cloud and provides users with the ability to host and join virtual meetings, webinars and online events.

- Cloud storage. Cloud applications such as Dropbox provide cloud storage and synchronization services. Users can store and share files across multiple devices and access them from anywhere with an internet connection.

Cloud apps vs. desktop apps

Cloud apps and desktop apps have distinct characteristics and advantages. Here's a comparison between the two app types:

- Desktop applications are platform-dependent and require a separate version for each operating system. The need for multiple versions increases application development time and cost and complicates testing, version control and support. Conversely, cloud applications can be accessed through a variety of devices and operating systems and are platform-independent, which typically leads to significant cost savings.

- Every device on a desktop application requires its own installation. Because it's not possible to enforce an upgrade whenever a new version is available, it's tricky to have all users running the same one. The need to provide support for multiple versions simultaneously can become a burden on tech support. Cloud applications don't face version control issues since users can access and run only the version available on the cloud.

- Desktop apps can run offline as they're installed on individual machines, but cloud apps require an internet connection to operate.

- Cloud apps typically provide real-time collaboration features enabling multiple users to work simultaneously on the same documents. Desktop apps don't provide real-time collaboration.

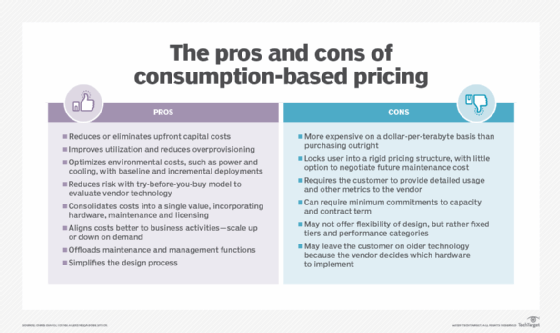

- Cloud apps often follow a subscription-based or pay-as-you-go model -- also referred to as consumption-based pricing -- where users pay for the services they use. Desktop apps on the other hand involve upfront licensing costs and users may need to purchase licenses for each device.

Testing cloud apps

Testing cloud applications prior to deployment is essential to ensure security and optimal performance. The following reasons highlight why testing should be performed on the cloud apps:

- A cloud application must consider internet communications with numerous clouds and the likelihood of accessing data from multiple sources simultaneously. Using API calls, a cloud application might rely on other cloud services for specialized processing. Automated testing can help in this multi-cloud, multisource and multiprovider ecosystem.

- Testing should be done to ensure that a cloud application can perform under certain circumstances such as network latency or high user load. This can help identify bottlenecks and optimize the application's performance.

- The maturation of container and microservices technologies has introduced additional layers of testing and potential points of failure and communication. While containers can simplify application development and provide portability, a proliferation of containers introduces additional complexity. Containers must be managed, cataloged and secured, with each tested for its own performance, security and accuracy. Similarly, as legacy monolithic applications that perform numerous, disparate tasks are refactored into many single-task microservices that must interoperate seamlessly and efficiently, test scripts and processes grow correspondingly complex and time-consuming.

- Testing can help identify vulnerabilities in the security of cloud applications as well as protect sensitive data. For example, penetration testing and data testing can mitigate potential attack vectors, including advanced persistent threats, distributed denial of services, phishing and social engineering attacks.

- Cloud applications must be tested to ensure processing logic is error-free. Test procedures may be required to conform to rules established by a given third-party provider.

- Cloud applications should be tested to see if they can scale effectively and handle spikes in traffic. Testing cloud applications can help identify scalability issues and ensure that the apps can handle the expected workload without performance degradation.

Complexities in cloud environments, including challenges related to visibility and misconfigurations, can pose security risks. Discover the steps involved in performing a thorough cloud security assessment.