4 steps to a blockchain implementation

If you're not experimenting with blockchain, you're behind the curve. Our step-by-step guide on implementing blockchain dissects the challenges, best practices and payoffs.

Bill Caraher envisions the day when blockchain technology will "substantiate and with zero doubt prove" the origins of documents and contracts used in the legal industry. For Caraher, CIO and director of operations at von Briesen & Roper, a 250-employee law firm in Wisconsin, this capability would be monumental.

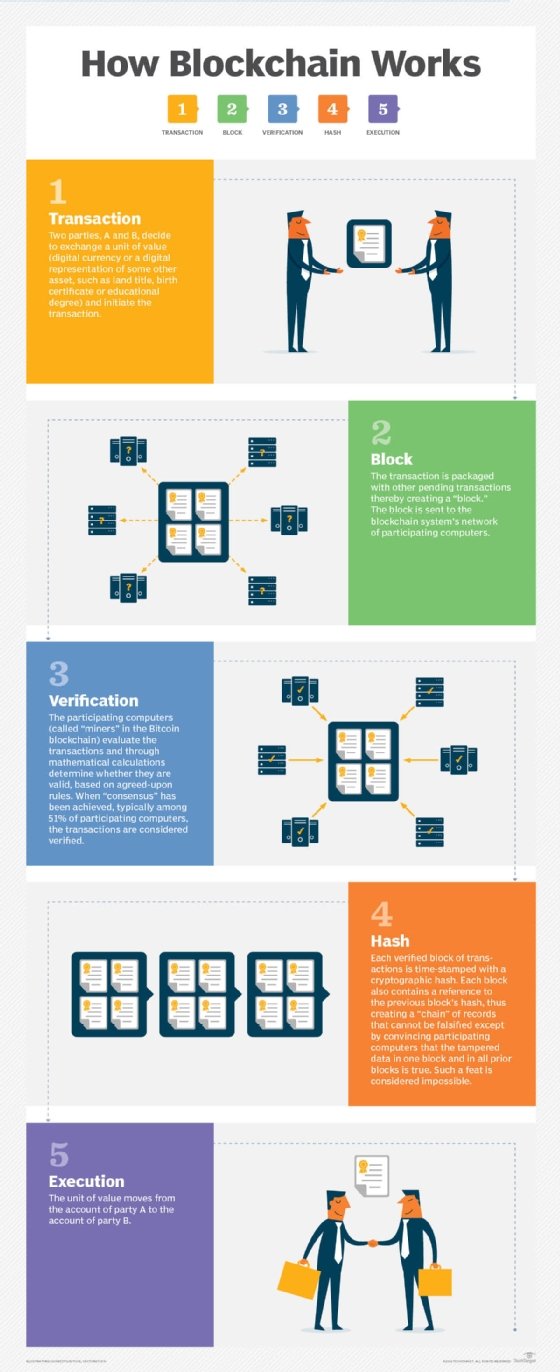

Blockchain technology -- in which a peer-to-peer distributed network is used to validate transactions and other records and thereby create an immutable digital ledger -- will have "sweeping implications" around provenance and authenticity of legal documents, he said.

A blockchain implementation could determine "the authority of documents and [prove] their originality, their state, their disposition, their destruction, and just be the index of the real story," Caraher said. "It could lead to speedier resolutions, it could lead to better evidence gathering [and establishing] foundation for a case."

Caraher eagerly anticipates the development of distributed ledger technology that would help make that promise a reality. But like many of the potential use cases for blockchain technology, the one Caraher foresees hasn't yet been fully developed or productized.

Indeed, potential use cases are a favorite topic among blockchain observers, and it seems that every conversation about the technology yields a new one. But sorting through which blockchain use cases actually make sense takes some work. And then having software -- and in some cases hardware, for IoT-enabled scenarios -- to put that use case into action is another step. But companies will eventually get there, proponents said, through concerted and judicious efforts among CIOs, IT practitioners, IT vendors and developers alike.

Before blockchain implementation, determine applicability

IT's involvement with blockchain implementations -- and therefore the level of urgency associated with putting distributed ledger technology into operation -- will to some degree depend on the vertical industry the company is in, with financial services being the most urgent. But as evidenced by Caraher's enthusiasm for blockchain's application to legal services, interest in the technology is widespread. Vendors active around blockchain -- both broad IT vendors such as Microsoft and IBM, as well as niche blockchain suppliers -- said they're fielding calls from virtually all industries. In addition to financial services and legal industries, others include: insurance, utilities, public sector, advertising, healthcare, auditing, supply chain, manufacturing and real estate.

Bill Caraher

Bill Caraher

Banks are under particular pressure to get going on blockchain implementations because they're facing pressure on three fronts, said Jeff Garzik, co-founder at Bloq, a startup focused on helping enterprises build blockchain platforms. Technology companies like Apple and Google are rolling out payment software; telecom companies are enabling consumers to use their mobile phones as a bank account, to pay bills and send money; and cryptocurrencies such as Bitcoin and Ethereum, which are underpinned by blockchain technology, are being used to disrupt banks much the same way tech and telecom companies are. But, he said, the disintermediation to banks will not be all-encompassing. "You're not going to have Aunt Joan and Uncle Joe store all of their wealth on their smartphone, for example. Banks are still going to exist and provide loans and provide services that strictly cashlike Bitcoin and Ethereum systems do not provide."

Yorke Rhodes III, global business strategist at Microsoft, said that the financial services industry got a head start on developing uses for blockchain technology because it had early awareness of Bitcoin. "It's pretty easy for people to be able to pivot and say, 'Well, we understand Bitcoin and the underlying technology. What else can we do with this? And, oh, by the way, this may be more disruptive to our business than Bitcoin because Bitcoin is really just a payment vehicle.'" Despite the -mover status of the financial services industry, many other industries will benefit from the technology, Rhodes said.

Four steps to a blockchain implementation

Garzik identified four stages to a blockchain implementation, and they apply no matter the industry a company is in:

- Identify a use case and develop a technology plan.

- Develop a proof of concept (POC).

- Administer a field trial, which involves a limited-production run with customer-facing data, and is stepped up to involve more customer-facing products and data volumes.

- Launch a full-volume rollout in production. (Relatively few organizations have reached Stage 4, Garzik said.)

When it comes to Stage 1, "the most pragmatic question [for IT to ask about blockchain] is, 'To what products does blockchain apply, but more pragmatically, how does blockchain not apply?'" Garzik said. "Some of the systems that are being converted are being explored more out of interest rather than being directly driven by customer value. So what areas of blockchain deliver the most customer value? That's the key question that CIOs should be asking."

Joe Guastella, global leader at Deloitte Consulting's financial services practice, said that some clients are approaching the firm with a clear idea that they want to understand how blockchain might be used, whereas others come to the firm with a business problem, with no preconception that blockchain should be used.

"There are people who are saying, 'We have these problems. ... We've got to take costs out.' And we kind of shape out and scope out the problem statement. And then you look at what the solutions may be," Guastella said. "And then you have some that say, 'You know what? This may lend itself to a blockchain solution because it'll cut out these 10 post-transaction reconciliation steps and therefore you can save this much money.'"

Step 1: Use case development

Regardless of how the use case is discovered, companies that have identified a use case for a blockchain implementation will either look to their vendor partners for a product that fits the bill, or will work to develop the technology internally.

Smaller companies are more likely to look to a vendor to supply a product. "I would see us working with one of our existing vendors to say, 'Are you forming an advisory panel or exploratory group of existing law firm clients that would want to roundtable about this and how do we see it as a benefit to the firm?'" Caraher said. He said that von Briesen & Roper would most likely work with its niche vendors in the document management space to see how they could incorporate distributed ledger technology into their products. Use of products employing distributed ledger technology would be a competitive advantage for his firm, Caraher said.

For larger companies, once a use case has been identified, Rhodes said, the next step is to identify an architecture to address the use case. And as with all IT projects, IT will need to determine budget, deadline and whether the work can be taken on using internal resources or whether outside help is needed. He said most companies will choose to contract for outside help with blockchain. "It's going to be way too hard to get up to speed in a sensible way across multiple complex technologies that are three or four different potential competing variants," he said.

Garzik, however, noted that whether doing a blockchain implementation internally or with outside help, it's important for companies to gain expertise in-house with blockchain technology because the technology is both new and complex.

For IT shops looking for help with a blockchain project, there's a very broad if still-immature ecosystem developing around the technology. According to a recent report from 451 Research, there are almost 300 Bitcoin and blockchain-related startups across the globe, operating to develop technology in the financial, productivity, storage, smart contracts, social networking, supply chain management, identity management, governance, retail and IoT product spaces. Most big IT vendors are active around blockchain, notably, IBM, which has put considerable resources behind The Linux Foundation's Hyperledger Project, and Microsoft, which is working with banking industry consortium R3 CEV to enable testing of blockchain systems using Microsoft Azure. And the large consultancies and systems integrators have also developed practices around the technology.

Step 2: Proof of concept

Bloq's Jeff Garzik describes the POC stage for a blockchain implementation as a one- to three-month exercise.

"You create a system ... that integrates into an isolated sandbox environment with that ... institution's data and you get to see the software operate in a simulated environment with real customer data. It does not impact customers, but it's real customer data, real transaction volume," Garzik said. "If you're talking larger volumes, a million transactions per day -- something of that nature -- you get to see how well the blockchain system scales up to meet that demand."

At the Consensus 2016 industry event in May, Catheryne Nicholson, CEO and co-founder at BlockCypher, which builds blockchain APIs, explained the POC process in a panel discussion. "[A POC is] very unmethodological in terms of engineering; it's something where you're trying to iterate quickly, fail quickly. It's the mantra of 10 engineers doing 10 projects in two months and seeing what's sticky."

Both Nicholson and Microsoft's Rhodes said the cloud is the best venue for a blockchain POC. "[Cloud computing] lets you spin stuff up without worrying about hardware [or] about it being inside your network," Rhodes said. Having it in the cloud also makes sense if there are multiple organizations participating in the POC, he added.

Even though testing may be done using public cloud services, most companies will relegate those tests to private or permissioned blockchains. "No enterprise is going to do the tests on the public blockchain, so I think you'll see a ton of use cases in development that are 100% internal only," Rhodes said.

There are obstacles that will derail a POC. At the Consensus 2016 event, Scott Mullins, who runs worldwide financial services business development at AWS, implored IT organizations to include all relevant parties in a POC.

"Don't forget you've got people down the chain that you need to include in the [POC] process. You've probably got a third-party outsourcing team, you've probably got a third-party oversight team, you've definitely got a compliance or risk management team," Mullins said. "Don't wait to get all the way to the end with your POC ... and you have five people who raise their hands and say, 'Hey, you need to talk to us about the different things we need to check the boxes on.'"

Eric Piscini, consulting principal at Deloitte's technology and banking practice, speaking on the same panel, advised against a widescale POC. "When we see POCs fail, most likely you start too big and think you're going to change the whole organization with blockchain. My advice: Start with something small that's going to impact a very small part of your organization."

BlockCypher's Nicholson cautioned against lengthy contracts tied to a POC. "From a startup perspective, we have been thrown a 150-page boilerplate master services agreement for a POC. It's way overkill. If you're an institution looking to do a POC, put that MSA to the side. Ask the startup if they will work with your four- to five-page agreement instead of going through months and months of negotiation with legal counsel, before you even start."

Step 3: Field trial

After POC comes the task of putting real data into production.

Garzik said this typically means a small trial with perhaps 5% of customers or customers on a lower-volume product. "IT staffs are locating within their customer product sets perhaps a lower-volume, perhaps less-customer-facing use case that they can then present both to the board at the CEO level and also to their engineers at the low level to really gain that knowledge."

Nicholson explained that the field trial isn't simply a POC moved to production but rather a restart. A field trial might have completely different requirements than a POC, she said.

Rhodes noted that once businesses become comfortable with the software they're using and are happy with the testing process, they may choose to implement blockchain projects on on-premises hardware within the enterprise rather than in the cloud.

Step 4: Full-volume rollout

Nasdaq's Linq system, which uses blockchain technology to manage private-market trades and which went live on Dec. 31, is an example of a blockchain implementation at Stage 3, Garzik said. "That's a field trial with real customers. But it's not as high-volume as turning the Nasdaq tech stocks on the blockchain. The number of trades for Microsoft or Apple stock is easily 10,000 times the number of trades on [a system like Linq]."

"Most customers are not yet at Stage 4," Garzik said. "Fortune 500 is really at Stage 2 POC or Stage 3 field trials with blockchain technology."

A full-scale production system requires a much greater commitment to the blockchain application than the prior stages. "Production is out in the wild, where it has to scale; all the users have to be happy, you have to have help desk. Essentially it begins to run on its own," Nicholson said.

And achieving that stage has so far eluded most blockchain projects.

"The only POC that's in production is Bitcoin. It's the only blockchain that is out in the wild, that has come under attack, that's stood the test of time," Nicholson said, adding that almost everything else is "a bright, shiny baby and is theoretical."