Project portfolio management: A beginner's guide

Project portfolio management is a formal approach used by organizations to identify, prioritize, coordinate and monitor projects that align with their strategy and goals. This approach examines the risk-reward ratio of each project, the available funds, the likelihood of a project's duration and the expected outcomes.

Unlike project management, which concentrates on the successful execution of individual projects, project portfolio management focuses on the big picture; it oversees an organization's entire portfolio of projects with the aim of maximizing the portfolio's overall value.

What is project portfolio management?

Project portfolio management, or PPM, is a top-down process. A group of decision-makers in an organization, led by a portfolio manager, examines each potential project to first determine if the project supports the goals and objectives of the business. Projects that fail this first criterion are eliminated from selection. The PPM team also examines the interconnections and contingencies among projects. These relationships can affect the ranking, prioritization, funding and selection of projects within the portfolio.

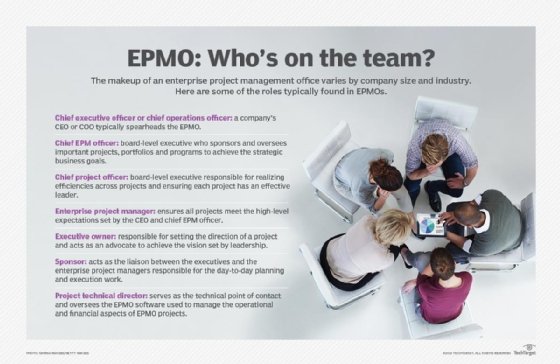

Once projects are identified and prioritized, the PPM group monitors projects that are in motion. Poorly performing projects can affect other projects within the portfolio, so consistent monitoring of the portfolio is needed to optimize overall value. At mature organizations, PPM decisions are made under the auspices of or in conjunction with a project management office (PMO) -- or an enterprise project management office in the case of organizations that have multiple PMOs assigned to individual projects.

PPM managers often report to a CFO or COO, but this can vary depending on the structure, size and complexity of an organization -- as can the size of a PPM team, which on average ranges from two to 20 people. PPM's centralized governance structure helps ensure projects add up to more than the sum of their parts. But portfolio management can be difficult to implement, requiring an understanding of the organization's strategy and business objectives, a consensus on which projects best achieve those objectives, enterprise-wide application of best practices and strong executive-level support, among other demands.

TechTarget's introductory guide to project portfolio management examines the nuts and bolts of PPM, laying out the steps involved in the process, its benefits and challenges, and how it differs from other approaches organizations use to maximize the value of their projects. We also delve into the broad market of PPM tools and software, including their ongoing adaptation by vendors in response to new ways of working and the need for enterprises to pivot quickly in the face of global crises, such as the COVID-19 pandemic and the war in Ukraine. Throughout the guide, there are hyperlinks to in-depth explorations of these and other relevant PPM topics, as well as to definitions of key concepts such as Agile project management, value stream management and risk-reward ratio.

The importance of project portfolio management

Project portfolio management functions as the bridge between an organization's overall strategic objectives and the set of individual projects needed to achieve them. The Project Management Institute (PMI), a not-for-profit professional association, explains that PPM "ensures that an organization can leverage its project selection and execution success" to help it "bridge the gap between strategy and implementation."

By examining all projects from the perspective of how well they align with strategic objectives, PPM not only helps drive an organization's collective effort to achieve desired outcomes, but it can also help accomplish those goals in cost-effective and efficient ways. Part of the job of the PPM group is to designate and monitor the methodologies, processes and technologies used to complete projects. Centralizing governance like this brings consistency to how organizations run projects, ensures resources are allocated to the most important projects, provides comprehensive risk management and generally improves communication between all levels of the organization, among other best practices.

Research firm Gartner singled out three elements of a mature PPM approach: portfolio alignment, ongoing portfolio flexibility and value-driven decision-making. Organizations that practice PPM have a marked advantage, according to the consultancy's research.

"Enterprises with mature strategic portfolio management practices are twice as likely as their competitors to achieve their business outcomes," Robert Handler, Gartner research vice president specializing in portfolio management, said in an interview with TechTarget Editorial.

How does the project portfolio management process work?

The project portfolio management process starts with identifying the organization's key business strategies and desired outcomes. In deciding which projects to greenlight and how they will get funded, the PPM group considers the organization's capabilities, including its people, processes and technology among other parameters that could affect the delivery of a project. The selection of projects is just the beginning of the PPM group's oversight role in project management.

Here are the basic steps the PPM process typically entails once the group agrees on business objectives and strategic direction:

- Plan the portfolio. This step involves inventorying and collecting info on existing projects and identifying proposed new projects. It could entail canvassing employees and outside consultants for ideas, assessing the competitive landscape, identifying areas for improvement and researching industry trends.

- Select and prioritize projects. PPM teams use various selection methods in ranking projects for strategic value and ROI, including sophisticated financial metrics (see "Project selection methods" below).

- Test the feasibility of the portfolio. This step requires working with the people who are involved in existing projects or will run proposed projects. Teams use data analytics and other metrics to assess individual project risks, including market changes and internal limitations in areas such as technology, skills and budget.

- Allocate resources. Once the projects are selected, the next step is lining up the funds, materials, personnel and other requirements to bring each project to completion.

- Manage, monitor and adjust. This phase requires working with project managers or PMOs to evaluate performance, identify problems and make adjustments as necessary to keep projects on track.

- Report and improve upon portfolio management. Regular updates to portfolio stakeholders pertaining to project performance, risks, personnel, etc., serve as the basis for continuous improvement and PPM maturity.

Project portfolio management vs. program management vs. project management

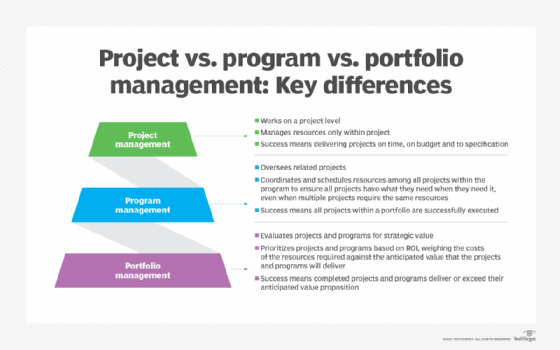

Project management, program management and project portfolio management are interrelated but have different objectives, as technology writer Mary K. Pratt explained in detail in her article on project vs. program vs. portfolio management. The following summarizes her observations:

- Project management uses established principles, processes and tools to guide a project from start to finish and ensure it is on time, on budget and to the desired specifications. PMI breaks down project management into five processes: initiating, planning, executing, monitoring and controlling, and closing.

- Program management addresses the reality that a project rarely exists in a vacuum. Large organizations will have many projects underway at the same time, some of which are closely related to each other, forming a program. These projects might require being done in a certain sequence and depend on shared resources. Program management, as Gartner's Handler explained, "is the overlay of management on top of those interdependent projects, so you have an element of coordination." It ensures teams have the resources they need when they need them and thus helps them meet the program's objectives on time and on budget.

- While project and program management focus on execution and delivery of particular projects, portfolio management pulls together all projects and programs to gain a strategic view of the work and ensure it supports the organization's overall objectives. "Portfolio is the next layer up," said Bob Pope, managing director of consulting firm Swingtide. "Program managers execute the game plan, but it's portfolio management that defines the game plan."

The chart below shows the key differences between the three disciplines and their unique objectives.

What is the role of the project portfolio manager?

Project portfolio managers evaluate all projects and programs from a strategic perspective. They have the authority to prioritize projects based on how important they are to the organization and allocate resources accordingly. The role includes the following responsibilities:

- creating a pipeline of projects and programs;

- aligning pipeline to enterprise goals;

- prioritizing projects and programs based on factors that include benefit and challenges;

- allocating resources;

- ensuring projects and programs are managed effectively and efficiently throughout their lifecycles;

- managing project portfolio risks, progress and issues;

- continuously monitoring and reporting on the portfolio;

- realigning and reprioritizing the portfolio when enterprise objectives or circumstances shift; and

- communicating to enterprise leadership the expected ROI for planned projects and programs.

Benefits of project portfolio management

Projects are big business. PMI has pegged the value of worldwide project-oriented activities to reach $20 trillion by 2027, up 67% from $12 trillion in 2017, with some 88 million people globally employed in project management roles.

"Quietly but powerfully, projects have displaced operations as the economic engine of our times. That shift has been a long time coming," project management authority Antonio Nieto-Rodriguez wrote in his 2021 Harvard Business Review (HBR) article "The Project Economy Has Arrived." Projects -- which always signify some kind of change, he said -- are "the lingua franca" of the business and personal worlds, as he put it.

Yet, project success rates remain dismally low. In his most recent HBR article, "How AI Will Transform Project Management," Nieto-Rodriguez and co-author Ricardo Viana Vargas stated that only 35% of projects today are completed successfully.

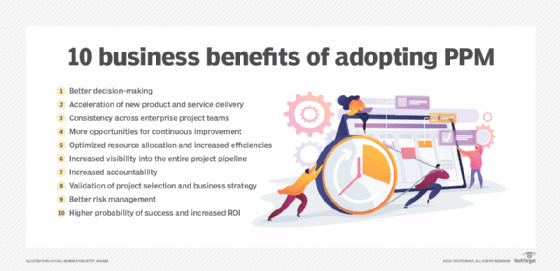

PPM can help boost success rates, Karen Willow, senior sourcing consultant at Swingtide, told technology writer Pratt in an interview on PPM benefits. Centralized management of the methods and technologies drives efficiency and generates higher project delivery success overall. The benefits described by Willow include the following:

- Better decision-making. PPM brings consistency to how organizations qualitatively and quantitatively evaluate projects through the project delivery cycle. "PPM takes the emotion out of projects."

- Increased visibility into the entire project pipeline. All project managers and teams are using the same tools and techniques to measure and report. "It's all on a level field for reporting."

- Increased accountability. Enhanced visibility translates into more accountability. "You can see how many projects you get on time and on budget, and then you're able to motivate everyone … to adopt the tools and processes they need to be more efficient."

The chart below provides a list of 10 PPM benefits, explained in more detail in Pratt's "10 benefits of adopting project portfolio management."

Challenges of project portfolio management

Despite the potential benefits, the complexity of PPM presents its own challenges. The scope of a project portfolio can be challenging, crossing multiple geographies, legal entities and functional areas, project management authority and PPM patent holder Mario Arlt pointed out in his classic 2009 paper on five steps to achieving a successful PPM outcome.

While setting the scope of the project portfolio too narrowly can diminish ROI, doing a smaller PPM pilot may make sense, Arlt argued, particularly at organizations just starting on PPM or whose project maturity across functions is inconsistent. At very large organizations, where a single governing body may be too removed from project goals, a "cascading" decentralized set of portfolios might make the most sense, he said.

For organizations taking on a PPM initiative, pitfalls to avoid are listed below:

- deferring to the loudest voice in the room due to the lack of a well-defined strategy;

- lack of specific objectives and goals;

- inability to operationalize and scale;

- under-resourcing the PPM initiative;

- lack of executive support;

- failure to fully implement governance, methodologies, standards and technologies;

- indecision on how much to centralize project management;

- opposition to centralization and tenets of PPM;

- no change management component; and

- failure to grow the maturity of the PPM function.

Check out Pratt's article on 10 challenges in project portfolio management adoption for more insight from PPM experts.

Project portfolio tips and best practices

PPM best practices are part and parcel of how the PPM process works and a guard against the common PPM challenges discussed above.

In summary, project portfolio management best practices include the following:

- securing executive support;

- casting a wide net to build a portfolio;

- aligning projects with organizational goals;

- scoping the portfolio to fit the organization's skills, operational capacity and culture;

- using tested methods to prioritize projects and balance the portfolio;

- enforcing standard project templates and processes to drive consistency;

- allocating resources based on project importance and need;

- monitoring project progress and addressing issues that arise in real time;

- managing and readjusting portfolio objectives as circumstances warrant;

- communicating with all PPM stakeholders;

- using PPM software and tools to help manage, inform and optimize performance;

- focusing on continuous improvement; and

- developing a portfolio project risk management plan.

Project selection methods

A project steering committee is sometimes appointed to determine where to best utilize the organization's funds for ROI. The project selection process often relies on the time value of money as an input. Time value of money uses a formula to determine either the present value or future value of a project based on some given assumptions. Here are the three common time value of money formulas:

- Future Value=Present Value (1+i)n. Here, i represents the interest rate and n represents the number of time periods for the project. For example, take a project that requires $525,000 as its budget and will last for two years. If the interest rate were 6%, the formula would read Future Value=$525,000(1+.06)2, which equals $589,890. This means that the project's ultimate value has to exceed $589,890 or it might not be a good investment for the organization.

- Present Value=Future Value/(1+i)n. Here, i represents the interest rate and n represents the number of time periods for the project. This formula determines what the assumed future value of the project is worth today. For example, a project that is believed to be worth $4.5 million upon completion in four years at 6% interest would be written in the formula as Present Value=$4,500,000/(1+.06)4, which equals $3,564,421.48. This means that if the project needs more than that amount to reach completion, it isn't a good investment for the organization.

- Net present value. This benefits measurement technique is used for projects that will have benefits and value each year that the project is in existence. Consider a global organization that will be updating its plant equipment across the globe for new efficiencies. The upgrade of the equipment won't happen in all of its production sites at one time but will be spread over five years. As soon as the first plant receives the new equipment, there are benefits from the project for that plant. As more and more facilities receive the new equipment, the benefits will accumulate for the organization. Net present value finds the present value for each year of the project and considers the cash outlay needed to complete the project to predict the actual worth of the project.

These project selection methods are financial-based decisions and don't consider factors such as the organization's need for the project, regulations, efficiency and productivity measurements. While the financial concern is just one aspect of selecting a project to be included in the organization's portfolio, it is a major concern because PPM manages the budget for all project endeavors.

Organizational maturity models in PPM

A maturity model describes how well an organization can select, manage and complete the projects within its portfolio. As the company becomes more mature, its selection and completion of successful projects becomes more and more exact. On the other hand, organizations that have only shallow experience with selecting, prioritizing and monitoring projects are more apt to have inconsistent results within their portfolio. Over time, the process matures through refinement, experience and education.

There are five levels of PPM in the associated maturity model, with each higher layer including the attributes of the lower layer. Naming conventions for the five PPM levels vary. The language below follows Gartner's model:

- Level 1: Reactive. This level has no formal project management tools, and management directives are based on the most needed projects first, although projects do have cost estimates. Younger organizations or ones with a more entrepreneurial bent are likely to be at this level of PPM.

- Level 2: Emerging discipline. An organization at this level has at least a PMO and ensures that all projects directly support an organizational strategy. There is a prioritization to the initialized projects, and the project managers are following a defined set of project management processes across all projects in the portfolio.

- Level 3: Initial integration. The organization uses programs to group together collections of projects within its PPM process. It also has clearly defined project manager and program manager roles, functional departments that collaborate across the organizational structure, and a PPM manager, project officer and/or project steering committee.

- Layer 4: Effective integration. The organization taps different knowledge sets from across the organization; monitors, tracks and forecasts benefits from each project; and models the project portfolio for risk, reward and ROI.

- Layer 5: Effective innovation. At the highest level of PPM maturity, all project changes and communications flow through an enterprise project management office. PPM projects are more quickly rolled out as compared to lower levels of the model, and project managers practice an iterative approach that breaks down project processes into smaller cycles called sprints or iterations for faster, more probable success rates.

In addition to each layer of the maturity model, PPM leadership is expected to examine the probability of success for each project, analyze the lessons learned and make adaptations to improve the flow of projects throughout the enterprise.

Examples of processes and techniques used in PPM

The primary processes used in PPM correspond to the steps described previously in the section on how project portfolio management works. To recap, they include the following:

- portfolio planning process

- project prioritization process

- feasibility testing process

- resource allocation process

- project monitoring process

- project reporting process

Other processes and analytical tools that often are used in PPM include the following:

Risk management. Risk management in PPM examines the risk of doing -- or not doing -- a project. The following are two tools commonly used in PPM to identify, predict, analyze and balance risk:

- Monte Carlo simulation. Named after games of chance in Monte Carlo, this approach uses computer software to model every possible outcome of a combination of factors. By simulating different factors, the software can show extreme outcomes, both positive and negative, and more likely outcomes for the project decisions. This helps the PPM team to make informed decisions in allocating funds, prioritizing projects, managing risk and so on.

- Decision tree analysis. A decision tree is a graph that uses a branching method to illustrate every possible output for a specific input. PPM teams use decision trees to model the likelihood of success for each project and determine the value of successful projects and the business cost of project failures.

Change management. Change management is the systematic approach to dealing with the transition or transformation of an organization's goals, processes or technologies. Its purpose is to implement strategies for effecting, controlling and helping people adapt to change. PPM teams use change management to help ensure projects are delivered on time and budget and align with the specified outcomes.

Agile project management. Agile project management is an iterative approach to planning and guiding project processes by breaking them into sprints or iterations. Tools used by Agile methodologies to track bodies of work -- e.g., stories and epics -- can be incorporated into PPM tools for greater visibility into projects.

Value stream management. Value stream management stems from value stream mapping, a practice with a long history in Lean manufacturing environments, such as Toyota's production plants. Value stream management techniques can be used in PPM to identify inefficiency and waste in the project delivery process and improve external customer satisfaction.

AI. The ability of algorithms to analyze large amounts of data can help PPM teams make more informed decisions about funding, priorities and risks. In their HBR article on AI and project management, Nieto-Rodriguez and Viana Vargas make the case that AI, machine learning and other advanced technologies will vastly improve project selection and prioritization, speed up reporting and facilitate testing. This can free up project and portfolio teams to focus more on coaching and stakeholder management, rather than administrative and manual tasks.

Project portfolio management software and vendors

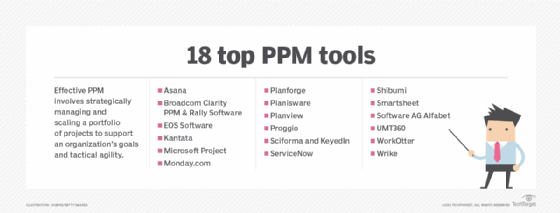

The broad range of planning tools available in the PPM market have traditionally been used by an elite group of professional project planners. But these tools are evolving to become more accessible, more intelligent and more agile in response to such factors as the rise in remote work, enterprise adoption of new cloud architectures and economic uncertainty, explained technology writer George Lawton in his deep dive into PPM tools.

Recently, Gartner has broken the PPM field into two disciplines: strategic portfolio management (SPM) for longer-term planning, and adaptive project management and reporting (APMR) for tactical and continuous decision-making. A few vendors are joining these two capabilities together, Lawton wrote, but it is still early days for this kind of integration.

Meanwhile, Lawton said, current PPM tools can increase the value of portfolio management by enabling organizations to do the following:

- allocate assets more efficiently;

- coordinate competing goals from different departments and business teams;

- drive operational efficiency;

- improve productivity;

- minimize project dependency bottlenecks;

- prioritize the highest-value projects;

- reduce duplication across projects; and

- spread risks across multiple projects.

Here are some top vendors to consider in 2023, according to Lawton:

- Broadcom Clarity PPM and Rally Software is built for large-scale projects. The package from Broadcom supports enterprise-wide PPM, offers value stream management capabilities and Agile development processes. This makes it a good fit for larger organizations, particularly in manufacturing, finance and healthcare.

- EOS Software simplifies IT integration. The EOS platform helps to coordinate the work of strategy officers, program managers and enterprise architects. It also has several features for adaptive planning, application portfolio management, scenario planning and resource management -- making it a solid option for improving connectivity between strategic planning and new IT services.

- KeyedIn Solutions helps transition from project delivery to portfolio value. KeyedIn's software focuses on improving project management and extends core capabilities to support enterprise PPM, SPM and APMR. It can also help improve digital transformation efforts.

- Monday.com streamlines work and project collaboration. Monday.com's suite of features improves project and work management in hybrid office scenarios with templates that help organizations get started quickly and tools that facilitate collaboration.

- OnePoint Projects supports Waterfall and Agile projects. OnePoint brings a strong focus on APMR capabilities and supports both Waterfall and Agile methodologies, giving enterprises the ability to combine approaches.

- Planisware transforms vision into reality. PPM software from Planisware provides a single shared view across project and portfolio management functions. It has support for both APMR and SPM and for process automation, and it is widely used by larger companies in industries like financial services, life sciences and manufacturing.

- Planview connects architecture to business goals. Planview is a large PPM vendor offering a comprehensive set of APMR capabilities, enabling businesses to pivot quickly when their needs change. It also supports SPM, connecting strategic planning with enterprise architecture.

- Proggio builds a project map. Proggio's powerful APMR capabilities support project and work management. Its novel approach to data presentation uses connected layers to create a digital map of project and portfolio progress.

- Sciforma combines portfolio and work management. The vendor's PPM software offers mature SPM and APMR capabilities that have evolved over the last 30 years. It's widely used across industries, including biotech, financial services, healthcare, manufacturing and telecommunications.

- ServiceNow aligns IT with business objectives. A strong presence in cloud-based IT service management, ServiceNow supports performance analytics, demand management, resource management and innovation management, aligning IT and business objectives. Extensive monitoring and reporting capabilities and the ability to automatically implement new ideas through low-code tools and assess the results before scaling them up are additional pluses.

- Shibumi aims for ease of deployment. Provisioned as a cloud-based PPM service, Shibumi provides a single source of truth with real-time visibility and includes tools that deliver both financial and nonfinancial metrics and results. Its direct integration with various robotic process automation tools is a powerful feature, too.

- Smartsheet connects the dots between strategy and execution. This platform provides customizable templates that help companies and departments get started with individual projects and then connect them into portfolios. Simplicity and a familiar spreadsheet-like interface are core strengths.

- Software AG Alfabet provides comprehensive capabilities. Since acquiring Alphabet PPM in 2013, AG has increased the breadth and depth of its PPM capabilities. The result is better linkage between IT, business, finance and risk. The software also comes with an extensive set of AI and machine learning capabilities for discovering portfolio shortcomings.

- UMT360 drives business agility. As a cloud-based platform with separate modules for analytics and enterprise integration, UMT360 is specifically designed to help drive business transformation. It also supports a collection of industry reference models to guide new projects. Packaged applications, called Accelerators, help customers get started quickly.

- WorkOtter provides prescriptive guidance. A cloud-based PPM tool with a powerful set of APMR capabilities, WorkOtter's core strength is its templates that help teams follow project management industry best practices.